In this episode of WealthTech Unwrapped, Ned speaks to Anders Jones, the CEO and Co-Founder of Facet Wealth. They discuss the pressing need for change in the financial advisory industry, identifying three primary challenges: the high cost of financial advice, conflicted fee structures, and a narrow focus on retirement and money management.

Acknowledging the industry's shift away from commission-based structures, Anders critiques the alignment issues with AUM models and emphasizes the necessity for fair and transparent pricing. The conversation acknowledges the role of technology, particularly AI, in reshaping financial advisory services. Automation is seen as a means to enhance advisor efficiency and improve the overall client experience. The discussion also highlights the importance of education in customer acquisition, promoting an "edutainment" approach to inform clients about financial planning.

Looking ahead, the shared vision is for the industry to evolve and redefine financial planning by prioritizing client goals and outcomes over AUM growth. The aspiration is to establish an industry standard that aligns more closely with client needs, offering accessible and transparent financial advice to a broader audience. This inspiring tale of building a mission-driven business shows how digital innovation can expand important services to many more people who've never worked with an advisor.

Key Takeaways:

1. Recognizing flaws in an entrenched industry from an outsider perspective can provide insights to disrupt the status quo and better serve customer needs.

2. Leveraging technology, particularly automation, presents a transformative opportunity to reduce costs and enhance efficiency in financial advisory services.

3. Embracing an educational and transparency-driven approach not only addresses the shortcomings of the current market but also unlocks new opportunities by meeting the needs of previously underserved customers.

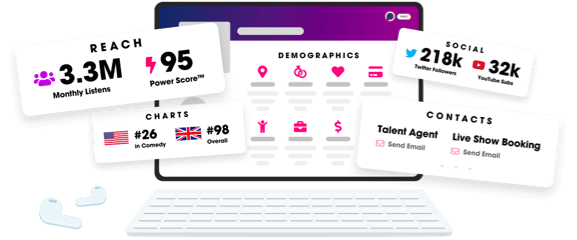

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us