Episodes of The Financial Philosophers

Mark All

Send us a textIn today's episode, Chris and Danny have a discussion about the issues with inheriting an IRA. IRAs are a common type of account. Most people have one. Everyone also dies at some point, so the chances of someone inheriting an IRA

Send us a textThe Childfree Guide to Life & Money by Dr. Jay Zigmont, CFP® Pre-Order Link. Anyone who preorders can email their receipt to media@childfreewealth.com & they'll be entered into a drawing for a free Childfree Wealth Checkup ($500)

Send us a textIn today's episode, Chris and Danny explore the importance of discussing finances with your current or future spouse. In fact, your choice of spouse may be one of the most important financial decisions you ever make. The alignment

Send us a text Support the Show:patreon.com/TheFinancialPhilosophersIf you would prefer the video version of this podcast, join us on our YouTube channel over at https://www.youtube.com/@financialphilosophers To contact us for Interviews or Bus

Send us a textIn today's episode Chris and Danny discuss the nuances of sequence of returns risk, who it applies to, the importance of raising awareness about it, and some steps one can take to mitigate it. Sequence of returns risk affects ever

Send us a textIn today's episode, Chris and Danny discuss the pros and cons of turning your hobbies into side hustles for extra income. There are many different ways to monetize your hobbies, but not every method is going to work for everyone.

Send us a textIn today's episode, Chris and Danny cover the top 5 things you should do to survive a market crash. Market volatility can be very stressful, and nobody likes to see red in their investment accounts. During these times of stress, p

Send us a textIn today's episode, Chris and Danny discuss the unique opportunities available to travel nurses who want to achieve FIRE. They cover a laundry list of pros and cons to consider with these types of jobs, as well as who it might be

Send us a textIn today's episode, Chris and Danny discuss the best debt repayment strategies to consider when tackling debt. Those debt repayment strategies are the Debt Snowball Method, Debt Avalanche Method, and Cash Flow Index (CFI) Method.

Send us a textIn today's episode, Chris and Danny discuss the importance of disability insurance and all of the nuances that come with it. Disability insurance is often ignored, yet it happens to be one of the most crucial types of insurance so

Send us a textIn today's episode, Chris and Danny discuss a financial thought experiment. How much money do you need to save to earn one year of financial independence or retirement? Thinking in very large numbers is counter-intuitive to most p

Send us a textIn today's episode, Chris and Danny have a discussion about when it is (or is not) appropriate to use your emergency fund. Having an adequate emergency fund is the foundation of good financial health, and it is important to make j

Send us a textIn today's episode, Chris and Danny challenge you to earn is as much money as you can by taking one PTO day and doing some financial spring cleaning. Do you think $2,500 is an unrealistic number? You might be surprised by how much

Send us a textChris and Danny have a challenge for you. The $50,000 Challenge. Do you think you can handle it? Approximately 60% of Americans cannot come up with $1,000 in an emergency. Furthermore, approximately 60% of Americans have less than

Send us a textEveryone has heard the term "diversification" before. Most people have also been told it is important to be "diversified" in their portfolio. However, most people do not fully understand what diversification means. In today's epis

Send us a textMany people are interested in learning more about how dividends might complement their portfolio. However, did you know there is a difference between ordinary dividends and qualified dividends? In today's episode, Chris and Danny

Send us a textIn today's episode Chris and Danny discuss a motivating thought experiment about paying off debt. Many people are motivated by the idea of saving up enough money to provide passive income to support their living needs. A similar m

Send us a textIn today's episode, Chris and Danny continue their conversation about investment returns. Topics covered include simple interest vs. compound interest, how not all interest compounds the same, APR vs. APY, and common misconception

Send us a textIn today's episode, Chris and Danny have a casual conversation about what investment returns actually mean. Many people get hyper fixated on their investment returns, but don't actually understand the full picture. Do you know the

Send us a textIn today's episode Chris and Danny have a discussion with Anson Young from The Property Squad podcast. Anson is a real estate investor, real estate agent, and author. You can also find Anson's content on BiggerPockets. Our discuss

Send us a textIn today's episode, we have a candid conversation about infinite banking through the use of a participating whole life insurance policy. What is infinite banking? Do some people take infinite banking too far? Is infinite banking a

Send us a textIn today's episode, Chris and Danny discuss using a Roth IRA as a supplement to one's emergency fund. This is an often under appreciated and overlooked strategy, as a Roth IRA offers more flexibility than meets the eye. Be sure to

Send us a textJoin us in today's episode, as we conduct our first interview on the show. Our guest, Eamonn, is a successful entrepreneur who runs a business as a 3rd party Amazon seller. Eamonn has many insights to share about the journey of be

Send us a textA health savings account (HSA) is a very unique and powerful vehicle to contribute to. However, the case for using an HSA depends on the individual, their situation, and their personal preferences. In today's episode we cover what

Send us a textThere are a lot of financial coaches and finance gurus on YouTube who promote the concept of Velocity Banking. Many of them claim that it is the ultimate strategy for aggressively paying off debt and decreasing interest. Others cl

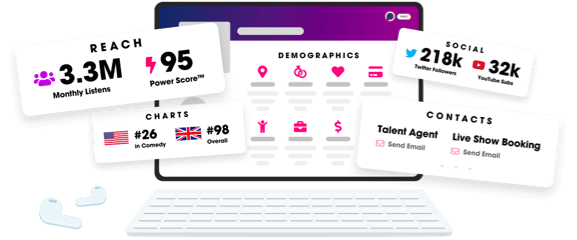

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us