Join me, Nik (https://x.com/CoFoundersNik), as I talk with Mark Brooks (https://x.com/markbrooks), the Managing Director of Permanent Equity, a unique investment fund founded by Brent Beshore. With 16 businesses and 900 employees, Permanent Equity uses a 30-year fund model and focuses on debt-free acquisitions, which goes against the grain in private equity. We discuss how they identify unique metrics for each business, incentivize operators without using EBITDA, and manage post-sale relationships.

Questions this Episode Answers:

- What is Permanent Equity’s unique 30-year fund model?

- Why does Permanent Equity pursue debt-free acquisitions?

- How do they identify key metrics for each business?

- Why don’t they incentivize operators based on EBITDA?

- How do they approach post-sale seller relationships?

___________________________

🚨MY NEWSLETTER https://nikolas-newsletter-241a64.beehiiv.com/subscribe 🚨

Spotify: https://tinyurl.com/5avyu98y

Apple: https://tinyurl.com/bdxbr284

YouTube: https://tinyurl.com/nikonomicsYT

___________________________

This week we covered:

00:00 Highlights

00:19 Welcome to Nickonomics

01:15 Interview with Mark Brooks

02:00 Understanding Traditional Private Equity

05:27 Permanent Equity's Unique Approach

07:44 Incentive Alignment and Cash Flow

08:44 Newsletter Promotion

09:14 Challenges with Incentive Alignment

11:04 Structuring Purchases and Keeping Owners Onboard

14:38 Value Proposition and Legacy Considerations

17:29 Operational Support and Back Office Functions

23:02 Metrics and Day-to-Day Operations

25:59 Understanding Leverage Points in Business

26:40 Key Business Metrics Categories

27:45 Dogmatic vs. Flexible Business Approaches

28:24 Industry-Specific Metrics and Opinions

29:42 Tracking Metrics and Reporting

31:17 Managing a Portfolio of Businesses

33:19 Delegation and Business Growth

39:33 Characteristics of Successful Companies

45:06 Advice for Entrepreneurs and Personal Reflections

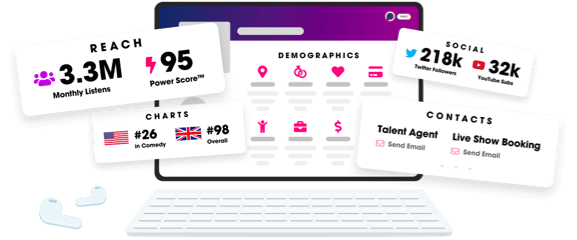

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us