Episodes of Market Action

Mark All

Software makers and semiconductors have come under pressure recently as investors question their multiples. But unlike a year ago, new sectors like financials and industrials may be coming into favor.

Stocks are paralyzed as investors wait to see if President Trump resolves his trade war with China. In the meantime, investors seem to be favoring new kinds of stocks. It’s time to prepare for the market’s next move.

Last month saw a fear bubble in the stock market as investors piled into safe havens. September’s been just the opposite as sentiment pivots sharply toward new places and away from traditional leaders.

The Federal Reserve rate cut demonstrated some basic principles for dealing with major news events like central bank meetings. Markets are forward-looking – learn how these events could impact your trading.

The Federal Reserve rate cut demonstrated some basic principles for dealing with major news events like central bank meetings. Markets are forward-looking – learn how these events could impact your trading.

This podcast reviews why semiconductor stocks are rebounding this year. It explores stronger orders, research, management calls and how 5G networks could fuel a new investment boom.

This podcast reviews how strong consumer data may reduce dangers of a looming U.S. recession. It also breaks down how the industry is undergoing historic change as demographics change and e-commerce spreads.

Fed Chair Jerome Powell speaks in Congress today with markets looking for the central bank to lower interest rates on July 31. Is he caving to political pressure from President Trump, or does a cut make sense now? Listen for more.

Explore the positives and negatives facing stocks as the S&P 500 consolidates at levels from April. Can a dovish Federal Reserve offset weakness in big companies like Apple and Facebook?

This podcast explores how companies like software makers and electronic payment firms are holding their ground despite the tariffs hammering other corners of technology. Listen for more.

The U.S. dollar is inching higher in a right range as President Trump’s trade war hurts the global economy. This podcast will discuss what it could mean for markets.

Volatility returned to U.S. markets in the last week as Washington and Beijing raised tariffs on each other. This podcast considers the seriousness of the issue and its likely impact on the U.S. economy.

Uber’s initial public offering (IPO) is scheduled for Friday. In this podcast we break down what it means for Uber and the broader technology sector.

The U.S. economy keeps silencing the naysayers. This podcast breaks down what’s happening and says what it could mean for financials, small caps and the U.S. dollar.

Facebook, Twitter and Microsoft are leading a rally in technology stocks. Some companies are repairing damage from last year, while others just keep innovating. The podcast also highlights some newer companies you may not know.

Healthcare stocks are getting hammered as investors worry about pricing pressures and political risks. Meanwhile, stronger economic data and positive earnings are drawing money into the financial sector.

Stocks have risen in the last 12 weeks - will investors start to worry about an expected drop in earnings when companies report in coming weeks? And a review of this year's strongest industries - semiconductors and solar energy.

David Russell breaks down market trends as the S&P 500 pushes against a key resistance zone.

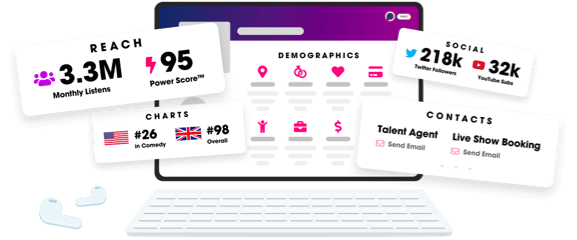

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us