Fixed Income Five

A daily Business podcast

Episodes of Fixed Income Five

Mark All

Jim Keegan, CIO and Chairman of Seix Investment Advisors, expects U.S. economic growth to remain anemic despite the Trump administration's potential impact on regulatory reform, tax reform, inflation, economic growth and monetary policy.

Mike Kirkpatrick, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, discusses how a potentially positive demand for high yield securities amid a potential drop-off in supply could affect the high yield market and hig

Ron Schwartz, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, believes that any tax reform that takes place in the next year or two is unlikely to impact the demand for municipal bonds from retail investors, who wi

George Goudelias, Managing Director and Head of Leveraged Finance at Seix Investment Advisors, notes that the fund is finding opportunities in health care and technology amid a constructive environment for both leveraged loan fundamental and te

George Goudelias, Managing Director and Head of Leveraged Finance at Seix Investment Advisors, views the leveraged loan environment as constructive through the end of 2016 as both the technical environment and fund inflows improved during the t

Jim Keegan, Chief Investment Officer and Chairman of Seix Investment Advisors, discusses the risk-on environment and the impact of the easiest Federal Reserve interest rate tightening cycle in history on the fixed income market and the economy.

Mike Kirkpatrick, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, believes that uncertainty surrounding a potential Fed rate hike may provide buying opportunities to fundamentally-oriented high yield investors.

Ron Schwartz, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, anticipates that the pre-election increase in municipal bond supply is likely to benefit investors through the end of the year.

George Goudelias, Managing Director and Head of Leveraged Finance at Seix Investment Advisors, notes that the impact of Brexit on the leverage loan market is likely to continue to be muted due to the fact that most companies that issue leverage

Mike Kirkpatrick, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, notes that higher energy prices have driven valuations higher in that sector of the high yield market, which may lead to profit taking on companies

Dusty Self, Managing Director and Senior Portfolio Manager with Seix Investment Advisors, expects that a high demand/low supply dynamic will continue in the municipal bond environment as the asset class benefits from a flight to quality.

Jim Keegan, Chief Investment Officer and Chairman of Seix Investment Advisors, discusses the long-term potential positive impact of Brexit on the UK and European Union and the rising recession risk in the United States.

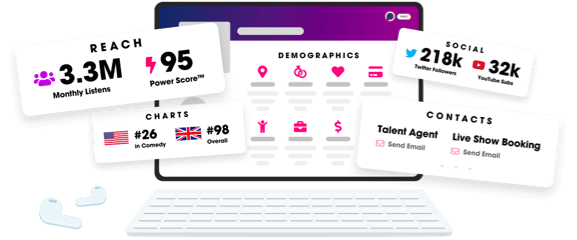

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us