Episodes of Budget Effect

Mark All

We are busy moms, taking care of a lot of things. So how can we protect our goals and visions? How can we stick with our goals?Answer: We must become a fierce protector of the goal. 1. Protect your time to have the vision. 2. Protect your time

What phase of budgeting are you in?Procrastination Phase? Beginning Budgeter?Been Budgeting For a While?Lost your Drive?Whichever phase you are in, I bet you can find a small step to take forward in this episode.Click here for the free Budget F

You know I talk more about a Values-Based Budget. So come along with me as I break down the pros and cons of a 50/30/20 budget. Click here for the free Budget Foundations Jumpstart!Let’s Connect:Instagram @budgeteffectpodcastEmail hello@thebudg

Fall is a great time to save money!In this episode we cover: 1. Why fall is a great time to cut spending2. How to set rules for a no-spend or low-spend fall3. Expenses that are coming up in fall and secondary options4. Fun and low cost activiti

If you want to success with budgeting, then meal planning is something you're probably going to have to stick to. In this final episode of our 3-part meal planning series, we really zoom in on how to make meal planning work for you. Click here

Today we have expert meal planner, Plandy Mandy, to share some of her top tips for how to meal plan, sticking to a meal plan, and how to meal plan on a budget.It's Part 2 of our 3-episode series on Meal Planning!You can find Mandy on her Instag

Meal planning is challenging for a lot of people! If you are doing well with meal planning then you should be proud! But regardless of the challenge, it's something that is beneficial for our budget, our nutrition and even our mental health.Thi

You are doing big things when you decide to start moving forward with money. So start to think bigger. It’s not just your budget and looking for good deals and finding out how to live frugally while you fix your money situation. It’s a holistic

Back to School means budgeting for school supplies, school clothes, working on our back to school routines, and thinking future forward about our school year budget and school year routines.In this episode we cover all those things. *back to sc

If you want to start budgeting, what should you do at the end of this month before you start next month?ORIf you wrote a budget for this month, but you haven’t looked at it since the beginning of the month, and now it’s the end of the month…wha

In this episode, we're getting into the importance and the how-to of budgeting for self-care. A little work up front can help you get exactly what you need and want for self-care in your monthly budget. Tune in to learn how to prioritize your w

If you want to get ahead with money, but you’re behind on bills or just can’t figure out how to get going, then this episode is for you. The main takeaway is that you must have a plan. And I have a proven plan that can work for you. This episod

BUDGET JUMPSTART CHALLENGELet's reflect on our wants and needs so that we can make better choices about our spending. Use these prompts to figure out if we are spending money and time on the things that are actually going to fulfill our needs.

Since we started the podcast, I've been saying we need to talk about sinking funds! In this episode I will break down sinking funds and how they can level up your finances. I will answer: What are sinking funds?How do sinking funds work in your

Got debt? Let's crush your money goals. As a single mom making 28k, I paid off thousands of dollars in debt. Let me give you 4 things that worked for me and maybe they'll work for you too. Click to join the BUDGET JUMPSTART CHALLENGE. This epis

Many people are stuck in a cycle of living paycheck to paycheck with seemingly no way out. But there is a solution! Of course you need a budget, but even more specifically - a weekly budget. This will help you get so intentional with your money

If you need help getting a budget started, start with these four things. BUDGET JUMPSTART CHALLENGESo if you have been wondering:How do I stick to a budget?How do I even get started with budgeting?How do I pay off debt?How do I invest when I li

If you want to move forward in life with money, in your motherhood, in your womanhood, then work on these three things. The great thing is that they are totally free to pursue. CLICK HERE for the BUDGET JUMPSTART CHALLENGE.Click here for the Wh

If you want to have an active summer, but you don’t want to break your budget, then this is the episode for you. We discuss preparing for summer with kids, summer routines, summer on a budget, budget friendly summer activities and more. Listen

If you have trouble sticking to a budget and reaching your money goals, then let's take a look at your shopping habits. And I'm not talking about LACK here. I'm not going to tell you that YOU CAN'T SHOP. I'm actually teaching you how to UPGRADE

Using your budget to live an intentional life is the goal. Since most of us value connecting and spending time with our kids, let's make sure we put that in the budget each month. This works both ways: 1. We value it, so we put it in our budget

This one-time, 20-minute activity could save you hours! Get organized by creating a “Monthly Essentials” list. Then save yourself so much time, save mental energy, stick to a shopping budget, and save money for years to come. My mission is to

[BONUS] This slightly off-topic bonus episode is an explanation of a practice that I used to finally release the negative emotions that would not leave me. I specifically used it to release anger and resentment. You could use to it to release a

My mission is for you to have less stress and more freedom, right? Well that doesn't just magically happen because you get your money in order. Money has a big part in your stability and your peace, but there are other things you have to let go

Sticking to a budget is a lot about having a mindset for it. You know you are doing what’s best, you know you are reaching your goals, you have a vision of your future, and that’s what keeps you going. So today I have a few unexpected places to

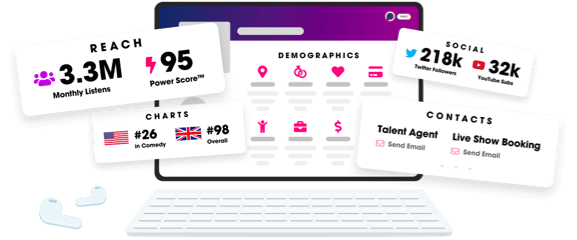

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us